sacramento tax rate calculator

Sacramento County collects on average 068 of a propertys. A full list of these can be found below.

Food And Sales Tax 2020 In California Heather

Method to calculate Sacramento County sales tax in 2021.

. Skip to main content. You can find more. Sacramento in California has a tax rate of 825.

A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. You can view property information and estimate supplemental taxes. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Sales Tax for Sacramento CA. As for zip codes there are around 80 of them.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates. You can view property information and estimate supplemental taxes. Sacramento Sales Tax Rates for 2022.

Sacramento County Sales Tax Rates for 2022. Tax rates are provided by Avalara and updated monthly. The current total local sales tax rate in Sacramento CA is 8750.

Enter your financial details to calculate. The December 2020 total local sales tax rate was also 8750. Sacramento County is located in California and contains around 24 cities towns and other locations.

After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate. A breakdown of the City of Sacramento sales tax rate. Sales and income taxes are generally high but effective property tax rates are below the national average.

The median property tax on a 32420000 house is 340410 in the United States. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. Method to calculate Sacramento sales tax in 2021.

Sales Tax Calculator Sales Tax Table. This search tool is maintained by an independent data service. Look up 2022 sales tax rates for Sacramento California and surrounding areas.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Our income tax calculator calculates your federal state and local taxes based on several. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in.

Our property tax data is based on a 5-year study of median. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The combined tax rate of 875 consists of the california sales.

Our Sacramento County Property Tax Calculator can estimate your property taxes based on similar properties. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending. West Sacramento in California has a tax rate of 8 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in West Sacramento totaling 05.

After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate of your supplemental tax.

California Sales Tax Calculator And Local Rates 2021 Wise

Cryptocurrency Taxes What To Know For 2021 Money

Understanding California S Property Taxes

Property Tax By County Property Tax Calculator Rethority

Cap Rate Calculator Formula And Faq 2022 Casaplorer

How To Calculate Sales Tax In Excel

California Sales Tax Calculator Reverse Sales Dremployee

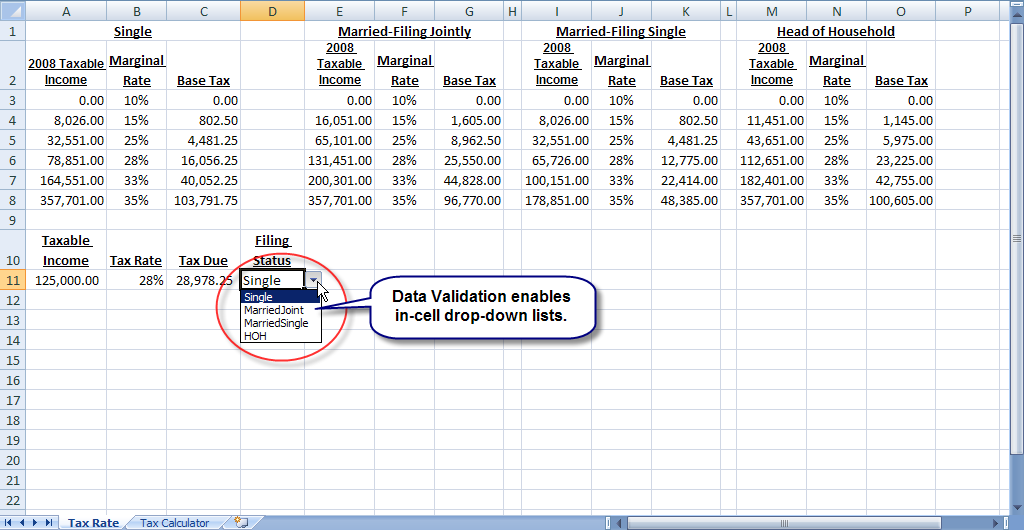

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Sales Tax Not Calculating To Shipping Address

4 Ways To Calculate Sales Tax Wikihow

California Tax Rates H R Block

What Are The Federal Income Tax Brackets Rates H R Block

Food And Sales Tax 2020 In California Heather

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Is A Flat Tax Rate Right For America How Money Walks How 2 Trillion Moved Between The States A Book By Travis H Brown